If a Saint Paul employee has questions regarding their rights under the Minimum Wage Ordinance, please contact the Labor Standards unit.

Employees are encouraged to know their minimum wage rights.

Read more about Minimum Wage Frequently Asked Questions

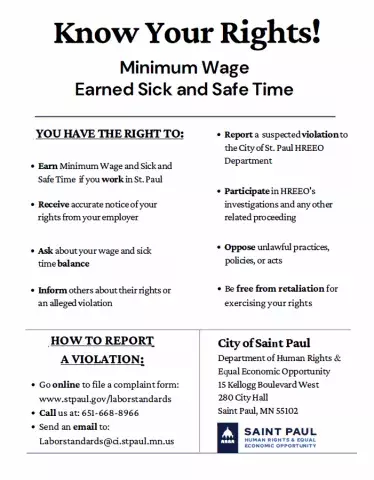

Under the Minimum Wage Ordinance, you have rights for the time you work in the City of Saint Paul, including:

Know Your Rights Flyer (English)

Know Your Rights Flyer (Spanish)

Know Your Rights Flyer (Hmong)

Know Your Rights Flyer (Somali)

Minimum Wage Schedules

| Macro Businesses & City of Saint Paul - More than 10,000 employees & City of Saint Paul employees | |

|---|---|

| Rate increase date | Rate |

| July 1, 2020 | $12.50 |

| July 1, 2021 | $12.50 |

| July 1, 2022 | $15.00 |

| January 1, 2023 | $15.19* |

| January 1, 2024 | $15.57* |

| January 1, 2025 | City Rate* |

| January 1, 2026 | City Rate* |

| January 1, 2027 | City Rate* |

| January 1, 2028 | City Rate* |

| Large Businesses 101 - 10,000 employees | |

|---|---|

| Rate increase date | Rate |

| July 1, 2020 | $11.50 |

| July 1, 2021 | $12.50 |

| July 1, 2022 | $13.50 |

| July 1, 2023 | $15.00 |

| July 1, 2024 | $15.57* |

| July 1, 2025 | City Rate* |

| July 1, 2026 | City Rate* |

| July 1, 2027 | City Rate* |

| July 1, 2028 | City Rate* |

| Small Businesses 6 - 100 employees | |

|---|---|

| Rate increase date | Rate |

| July 1, 2020 | $10.00 |

| July 1, 2021 | $11.00 |

| July 1, 2022 | $12.00 |

| July 1, 2023 | $13.00 |

| July 1, 2024 | $14.00 |

| July 1, 2025 | $15.00 |

| July 1, 2026 | City Rate* |

| July 1, 2027 | City Rate* |

| July 1, 2028 | City Rate* |

| Micro Businesses- 5 or fewer employees | |

|---|---|

| Rate increase date | Rate |

| July 1, 2020 | $9.25 |

| July 1, 2021 | $10.00 |

| July 1, 2022 | $10.75 |

| July 1, 2023 | $11.5 |

| July 1, 2024 | $12.25 |

| July 1, 2025 | $13.25 |

| July 1, 2026 | $14.25 |

| July 1, 2027 | $15.00 |

| July 1, 2028 | City Rate* |

*The rate is based on a percentage increase calculated by the Commissioner of the Minnesota Department of Labor and Industry pursuant to Minn. Stat. § 177.24, subdivision 1(f) and applicable to the State of Minnesota minimum wage divided by two (2) in 2022 and based on the full percentage increase in each subsequent year rounded to the nearest cent. The rate determined through this process for the City of Saint Paul and macro businesses as of January 1, 2023, will be $15.19.

If you are under the age of twenty and your employment meets certain criteria, your employer may be able to pay you an adjusted wage:

| Youth Wage | |

|---|---|

| Rate increase date | Rate |

| July 1, 2020 | $8.50 |

| July 1, 2021 | $9.35 |

| July 1, 2022 | $10.20 |

| July 1, 2023 | $11.05 |

| July 1, 2024 | $11.90 |

| July 1, 2025 | $12.75 |

| After July 1, 2025 | 85% of the City minimum wage, rounded to the nearest nickel |

Workplace Notice Posters

Your employer must provide viewable and noticeable notice of your minimum wage rights. The city provides a workplace poster with your applicable minimum wage based on your employer’s business size. Please see below for an example. If you have questions, please email us at laborstandards@ci.stpaul.mn.us.

ESST & Minimum Wage Poster - English

ESST & Minimum Wage Poster - Hmong

ESST & Minimum Wage Poster - Spanish

ESST & Minimum Wage Poster - Somali

ESST & Minimum Wage Poster - Karen

Review the Minimum Wage Ordinance and Minimum Wage Frequently Asked Questions to fully understand your rights.

Minimum Wage Frequently Asked Questions (Hmong)

Minimum Wage Frequently Asked Questions (Spanish)

Minimum Wage Frequently Asked Questions (Somali)

Minimum Wage Complaints

HREEO is responsible for resolving employee minimum wage complaints. If you believe your rights have been violated, complete the Complaint Form and submit it to the Labor Standards unit. After receiving the minimum wage complaint form, a city staff member will follow up with the complainant within five (5) business days.