Overview

The Downpayment Assistance Program (DPA) was developed to support the wealth-building opportunities provided by homeownership to low- and moderate-income households and to address racial disparities in homeownership.

Qualified homebuyers earning at or below 80% area median income (AMI) can receive up to $40,000 to use towards a home downpayment, closing costs, interest rate buydown, and/or property inspection for the purchase of a home in the City of Saint Paul. First-generation homebuyers are eligible to receive up to an additional $10,000.

In addition, homebuyers that are eligible for the Inheritance Fund layers may earn up to 100% AMI and can receive up to an additional $60,000 (for a total of $110,000).

The Downpayment Assistance Program is funded by the Housing Trust Fund.

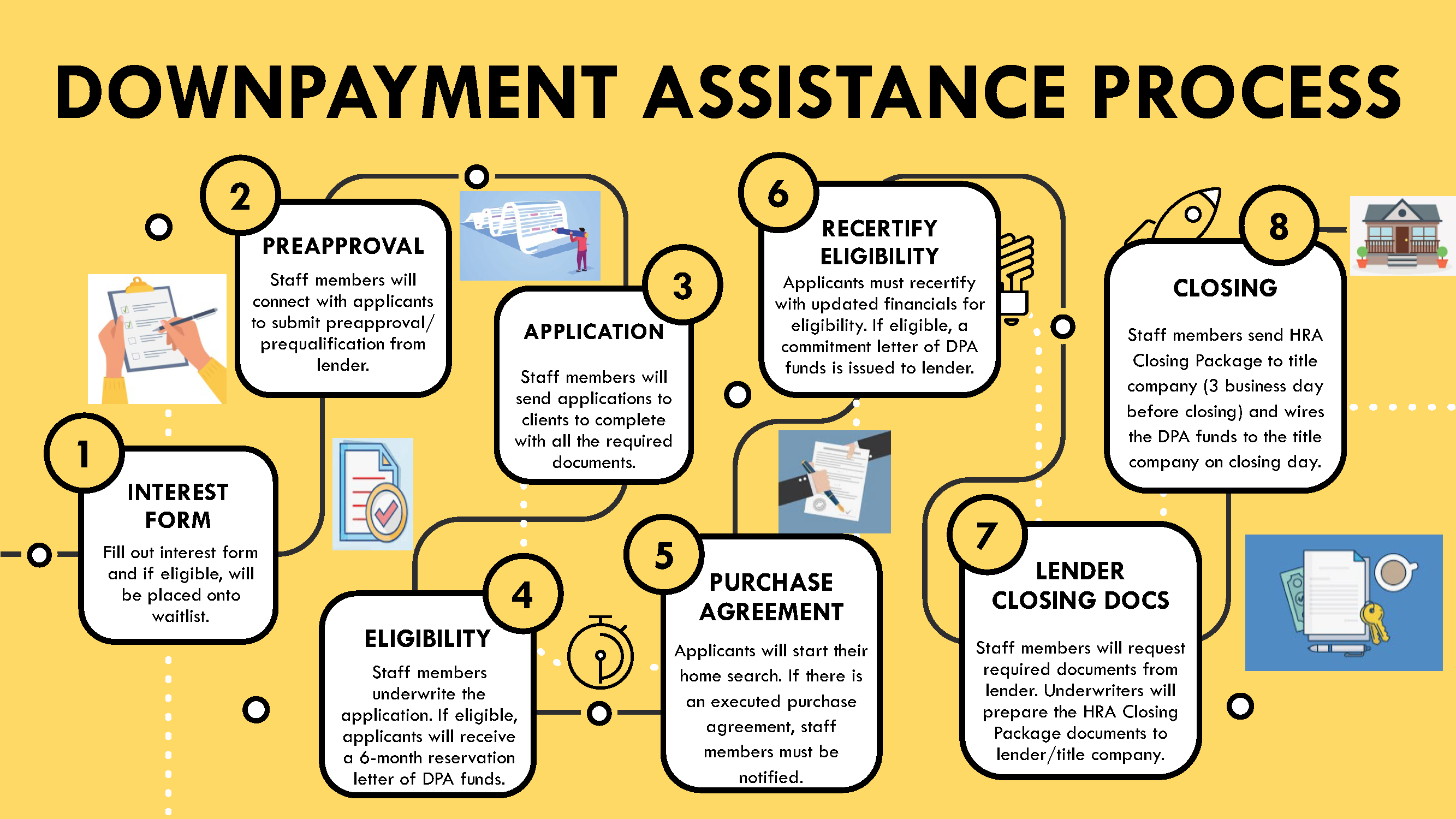

Once the initial information is reviewed, eligible applicants will be placed on a waitlist and staff will connect via phone and email on a first come, first served basis as funding allows. Please note there is high interest in this program.