About the Proposed Sales Tax

Saint Paul is a growing Capital City home to more than 300,000 residents and several Fortune 500 companies, health care organizations, and employers of all sectors. The downtown core has world-class entertainment venues like the Science Museum of Minnesota, CHS Field, Xcel Energy Center, and the Ordway, Palace, and Roy Wilkins theaters. And the parks and recreation amenities are the second-best in the nation, according to the Trust for Public Land.

Comprehensive improvements to Saint Paul’s regionally significant roads and nationally acclaimed parks and recreation facilities are estimated to cost $1 billion over the next two decades. To secure funding for estimated costs, the City of Saint Paul is proposing a one-percent increase in the local sales tax.

Download the Sales Tax Information Flyer

Street Improvements

Saint Paul’s arterial and collector roadways, bridges, and trail systems provide regional and national multi-modal connections for all different kinds of transportation. Approximately 200 miles of city-owned arterial streets connect users to the regional, state, and federal highway systems.

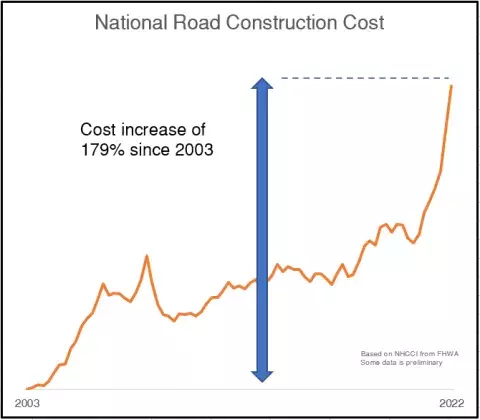

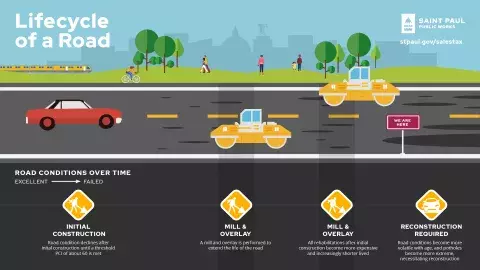

From initial construction to full reconstruction, roads have a lifecycle of about 60 years. Currently, Saint Paul streets are on a 124-year reconstruction cycle, more than double the average age of a functional road. According to a 2019 Pavement Condition Index (PCI) report conducted by Saint Paul Department of Public Works, the city-owned arterial and collector network has a current condition rating of 49 (“fair to poor”).

Public Works re-analyzed the pavement network in 2022, and at the current funding levels, the PCI condition of city-owned arterial and collector streets is expected to drop from 49 to 29 (“very poor” condition) within the next 20 years. Given the current condition of many streets, the pavement treatments—such as mill and overlay (resurfacing), seal coating, and pothole patching—are not lasting as long as they typically should.

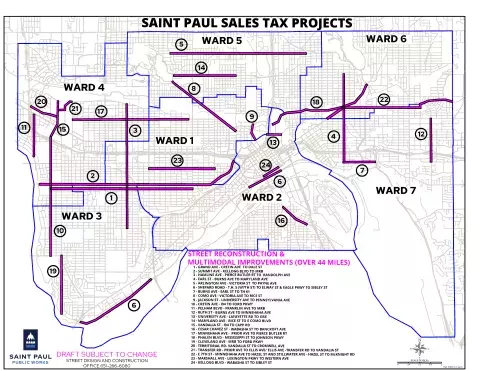

The revenue collected over 20 years will provide $738 million for road improvement and reconstruction projects throughout the city, including 24 arterial and collector roads, including some bridges, over 44 miles in each of the seven wards. The arterial and collector street system’s PCI will increase to an average of 70 (“satisfactory” condition) – an industry standard that governmental agencies strive to achieve.

Parks and Recreation Facilities Improvements

Each year, Saint Paul parks, trails, and recreational facilities attract more than 15 million visitors from all over the country. The average building is approaching 40 years, and coupled with years of deferred maintenance, the aging facilities are deteriorating.

The city’s Parks and Recreation Department has over $600 million in assets and a current deferred maintenance backlog of more than $100 million, including $60 million in critical or urgent status and $40 million set to reach critical or urgent status within the next five years.

The revenue collected over 20 years will provide $246 million for improvements and upgrades Parks and Recreation facilities throughout the city. This investment would revitalize aging parks infrastructure with a focus on the worst-condition parks, community centers, trails, connections, and athletic facilities. Revenue would also fund:

- A multipurpose community center on the city's East Side to serve a densely populated area and attract visitors from surrounding suburban cities

- A 21st century versatile, dedicated multi-sport/multi-use athletic complex for hosting local and regional tournaments, leagues, activities, and other events and programs

- A river focused environmental learning space and National Park Service headquarters at Crosby Farm Regional Park

- A 1.5-mile River Balcony promenade along the downtown bluff, which will transform urban infrastructure into a public space that connects parks and civic landmarks.