What is Common Cent?

In 2023, Saint Paul voters approved a 1% increase to the local option sales tax to be used for repairs and improvements to streets, bridges, parks, and recreational facilities within the city. The tax will generate nearly $1 billion over 20 years, of which $738 million is allocated for Saint Paul streets.

Street Improvements

From initial construction to full reconstruction, roads have a lifecycle of about 60 years. Currently, Saint Paul streets are on a 124-year reconstruction cycle, more than double the average age of a functional road. According to a 2019 Pavement Condition Index (PCI) report conducted by Saint Paul Department of Public Works, the city-owned arterial and collector network has a current condition rating of 49 (“fair to poor”). At the current funding levels, the PCI condition of city-owned arterial and collector streets is expected to drop from 49 to 29 (“very poor” condition) within the next two decades.

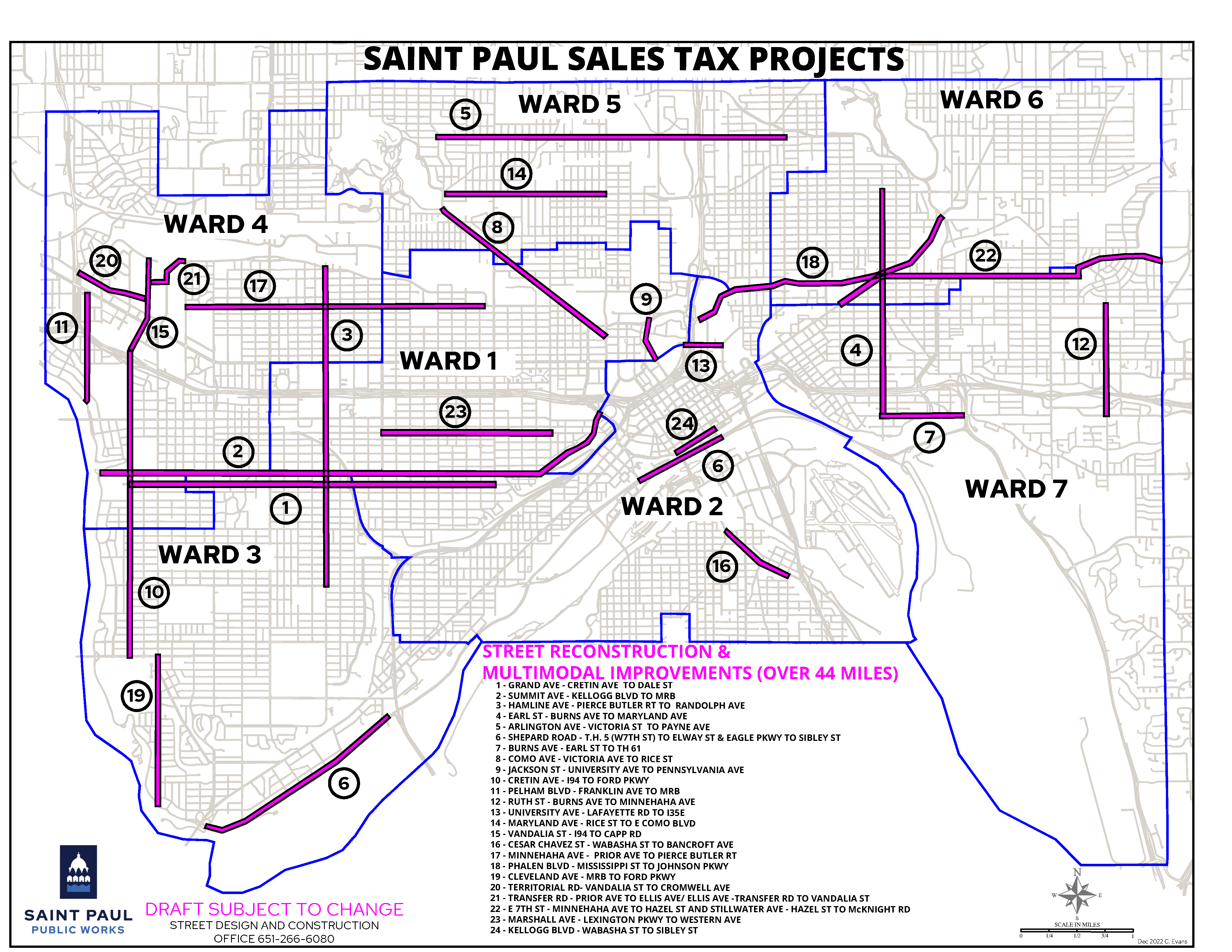

The revenue collected will fund road improvement and reconstruction projects throughout the city, including 24 arterial and collector roads—including some bridges—over 44 miles in each of the seven wards. The arterial and collector street system’s pavement condition will increase to an average of 70 (“satisfactory” condition), which is an industry standard.

Better Street Condition & Planning for the Future

As part of the referendum, voters approved 24 corridors to be included in Common Cent. These streets are important regional connections and key thoroughfares within the City of Saint Paul. As with other streets in the city, Common Cent corridors are in need of extensive repair, with many needing full reconstruction to bring the street up to modern standards for pavement quality, safety, and utility reliability.

This plan outlines a strategy to implement Common Cent street improvement projects over the next 20 years. It also describes the framework for how the City evaluated project priorities and sets a schedule to advance projects over the expected 20-year period of Common Cent sales tax collection. This sequence was determined based on technical merit, cost and program cash flow, collaboration with partner agency projects, and key policy factors such as advancement of other City of Saint Paul plans.