What is the Minimum Wage Ordinance?

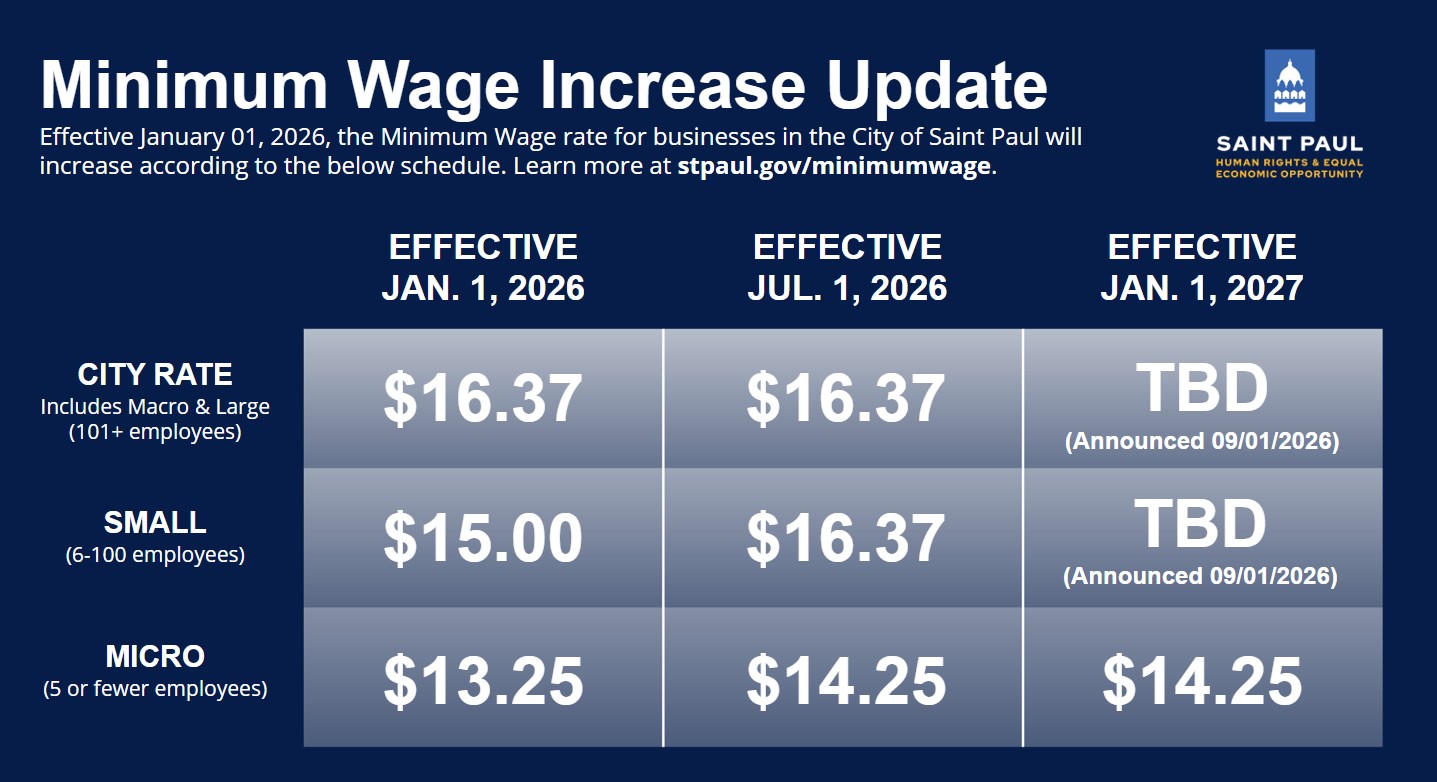

The Minimum Wage Ordinance sets the lowest hourly pay rate for work done in the City of Saint Paul. Minimum Wage requirements vary based on a business's size. The City will require businesses of all sizes to pay their employees a minimum wage of $15 an hour by 2027.

- Wages include salary, hourly pay, piece rate pay, commissions, and non-discretionary performance bonuses. Employer payments toward medical benefits and tips are not considered wages.

- Employers must keep track of where their employees are working. Records can include (but are not limited to) delivery addresses, estimated travel times, historical averages, dispatch logs, scheduling logs, and appointment details.

- Looking for information in Hmong? Watch this Hmong-language video created in partnership with 3HmongTV and Councilmember Nelsie Yang.

Click Here to Read the docx. Version of the Ordinance Click here to Read the PDF Version of the Ordinance

Contractors and subcontractors performing work for the City may be required to pay their workers the City's Prevailing Wage or Living Wage.

Prevailing Wage and Living Wage Ordinances

Who does the ordinance cover?

The ordinance covers all employees' hours of work in the geographic boundaries of the City of Saint Paul.

- Full-time, part-time, and temporary employees are all covered under the ordinance.

- Immigration status does not impact coverage of the Minimum Wage Ordinance.

- The ordinance does not cover independent contractors.